2024 年 5 月 8 日

+++ 一致的战略实施:按计划动态 BEV 增长与盈利能力保持一致 +++ BEV 继续按计划增长:第一季度增长 28%,达到约 83,000 辆 BEV +++ BMW 品牌销量增长 2.5% ++ + 高价位车型的交付量增长超过 20% +++ 第一季度集团息税前利润率高于 10% 以上的目标 +++ 息税前利润率连续九个季度保持在 8-10% 的目标范围内 +++ 展望2024 年已确认 +++

慕尼黑。宝马集团将在 2024 年继续其成功之路:在大力发展纯电动汽车的同时,该公司实现了利润目标。今年前三个月,该公司交付了约 83,000 辆 BMW、MINI 和劳斯莱斯品牌的全电动汽车,纯电动汽车销量增长了约 28%。宝马品牌整体销量增长2.5%。与此同时,根据全年指引,汽车业务的息税前利润率为 8.8%,处于 8-10% 的目标范围内。集团层面的息税前利润率为 11.4%,高于 10% 以上的战略目标。

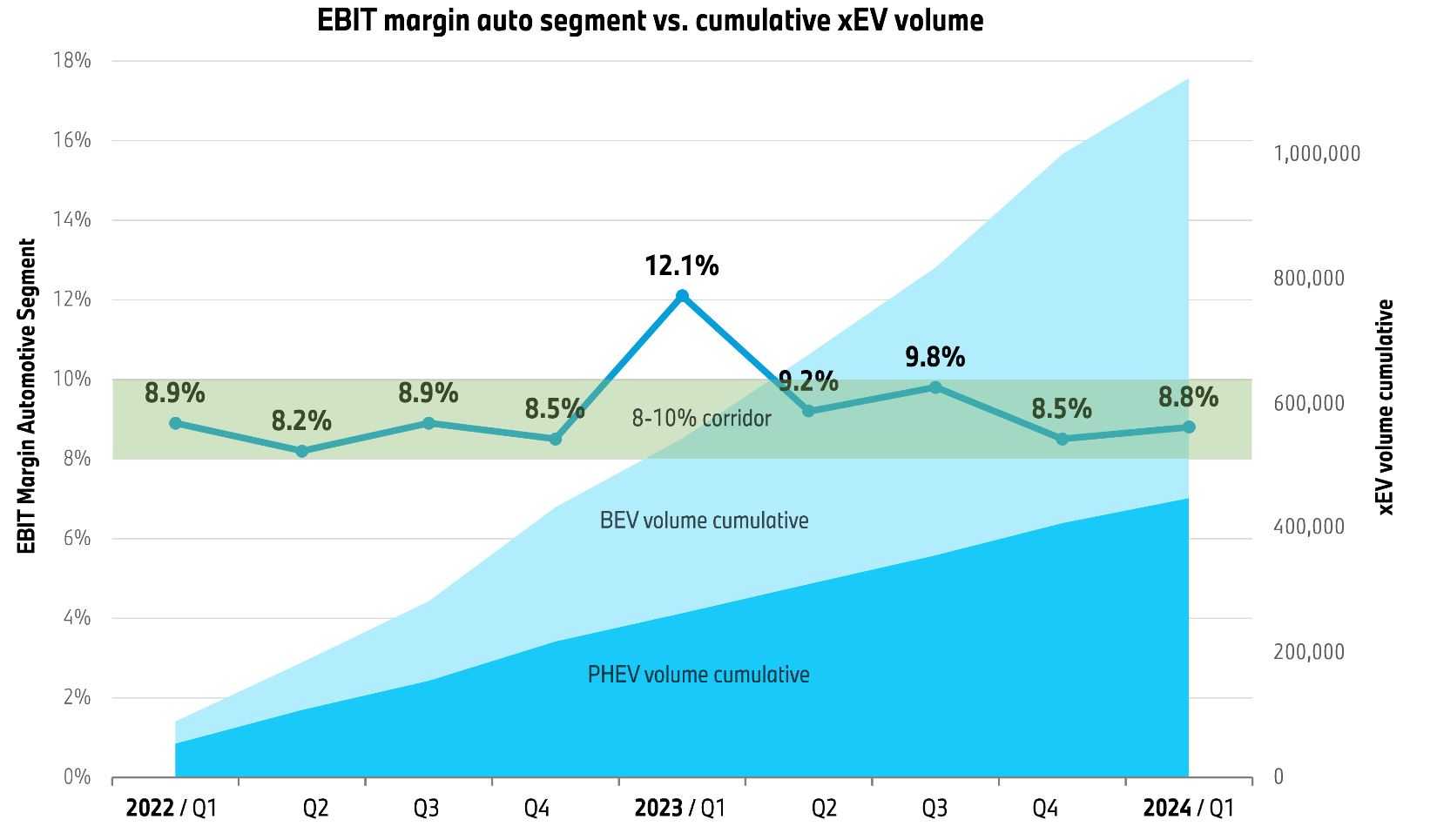

在经历了新冠大流行和半导体供应的挑战之后,自 2022 年第一季度以来,该公司一直在其 8-10% 的战略息税前利润区间内逐季度交付。这是在电动汽车快速增长的同时实现的:过去两年,宝马集团向客户交付了超过110万辆电动汽车。其中超过 60% 是纯电动 BEV 车型。纯电动汽车份额继续按计划稳步上升。

2023年第一季度,汽车板块的息税前利润率为12.1%。去年第一季度的息税前利润受益于 2022 年较低的采购价格水平,因为销售了制造成本较低的库存。与通货膨胀相关的制造成本增加影响了 2023 年第二季度后宝马公司的损益表。较高的成本水平已延续到 2024 年第一季度。

“过去九个季度凸显了宝马的连续性和可靠性:按照计划,我们正在动态扩大电动汽车的份额,同时保持高水平的盈利能力。有些人称之为转变——对我们来说,这是持续的进步,” 宝马公司管理委员会主席奥利弗·齐普策周三表示。 “我们将继续坚持这一方针:我们为客户提供涵盖所有车辆传动系统的最新创新和最新技术。因此,我们继续以强大的产品产生强劲的需求。”

汽车市场呈上升趋势——宝马集团交付量增加

前三个月,公司共向客户交付汽车594,533辆,同比小幅增长1.1%,再次确立了其在全球高端细分市场的领先地位。

在这三个月期间,主要汽车市场在追赶性购买和中等价位销量增长的基础上基本呈现上升趋势。宝马集团受益于其年轻且极具吸引力的产品线: 宝马品牌第一季度销量为530,933辆, 同比增长2.5% 。它在美国的销量增长了2.4% (84,475 辆),在 欧洲则显着增长了10.2% ,交付了188,863 辆。在中国,销量细分市场在较低价格范围内动态发展,而高端细分市场略有下降。宝马品牌销量为182,998 辆,与细分市场发展相符(2023 年:190,774 辆/-4.1% )。在 德国,高档汽车的交付量增长了4.6%,达到 49,509辆。

广受欢迎的 BMW i4* 以及 BMW iX1* 和 BMW i7* 是交付的78,682辆BMW BEV 中最大的增长动力之一。宝马品牌的 全电动汽车增长尤为强劲,增长了40.6%。宝马集团总共向客户交付了 122,582 辆电动汽车、纯电动汽车和插电式混合动力汽车,销售份额接近21%。

预计 BMW iX2* 和 BMW i5* 的销售势头将在今年进一步增强,目前它们的销售量正在不断增加。

全电动车型占总销量的比例增至13.9% (2023 年:11.0%)。高价位车型再次被证明是重要的增长动力——交付量增长了21.6%。

MINI品牌正在经历全面的车型转换。全新 MINI Countryman* 最近首次推出,配备纯电动传动系统以及熟悉的内燃机。紧随其后的是新款 MINI Cooper*,该车将于第二季度中旬上市,配备内燃机或全电动汽车。全电动 MINI Aceman* 最近在北京车展上庆祝了全球首发,这是该品牌首款针对高端小型车领域的跨界车型。这些新车型预计将在2024 年 2 月 2 日起带来更多动力。MINI 在第一季度向客户交付了62,075辆汽车(2023 年:68,541 辆/-9.4% )。

劳斯莱斯品牌凭借劳斯莱斯 Spectre* 在电动汽车领域首次亮相,令人印象深刻:仅在 2024 年第一季度,劳斯莱斯豪华品牌就向新主人交付了579 辆全电动超级轿跑车;交付的1,525辆汽车中有 38%是电动汽车(2023 年:1,640 辆汽车/-7.0% )。

经货币调整后的集团收入略有增长

第一季度集团收入 总计366.14 亿欧元 ,与上一年的历史新高持平(2023 年:368.53 亿欧元/-0.6% )。更高的销量和更有利的产品组合提振了集团收入。

集团息税前利润率超出目标 >10%

1 月至 3 月期间,宝马集团公布的税前收益 (EBT)为41.62 亿欧元( 2023 年:51.29 亿欧元/-18.9% )。 EBT 包括1.08 亿欧元的财务业绩(2023 年:-2.46 亿欧元),反映了利率和货币对冲交易的市场发展。这一时期的息税前利润率为11.4 %(2023 年:13.9%),高于 >10% 的全年目标。第一季度集团净利润总计29.51亿欧元(2023年:36.62亿欧元/-19.4% )。

宝马公司继续实施股票回购计划

经宝马股份公司2022年5月11日年度股东大会授权,公司启动股份购买。计划一中购买的股份已被取消。截至2024年3月31日,宝马股份公司持有8,004,314股库存股,面值为8,004,314欧元。根据该授权,宝马股份公司截至2024年3月31日购买了相当于股本5.03%的股份。

汽车行业 EBIT 利润率为 8.8%,处于全年目标范围内

汽车部门第一季度收入为 309.39 亿欧元(2023年 :312.68亿欧元 /-1.1% )。排除货币换算阻力,尤其是人民币和美元的阻力,收入同比增长+ 1.5%。高价位细分市场和纯电动汽车带来的更高销量和更有利的产品组合效应提振了细分市场收入,凸显了核心业务强劲的经营业绩。预计 2024 年整个产品系列的价格将与去年的水平保持一致。

第一季度财务业绩前利润 (EBIT)总计 27.1亿 欧元( 2023 年:37.77 亿欧元/-28.2%)。汽车息税前利润率为8.8%(2023 年:12.1%),因此处于 8-10% 的全年目标范围内。息税前利润受到制造成本上升的影响。如前所述,2023 年第一季度仍受益于 2022 年较低的采购价格水平。制造成本从 2023 年第二季度开始增加,并一直延续到 2024 年第一季度。

大宗商品价格的变化对息税前利润产生了三位数百万欧元的积极影响,而货币影响保持中性。宝马集团预计 2024 年全年货币和大宗商品头寸将出现正净余额。

租赁结束车辆的转售结果被证明对 2023 年第一季度不利,但仍保持乐观。从 2023 年第二季度开始, 由于车辆可用性的改善,竞争环境变得更加激烈。这导致新车和二手车业务的全球价格环境逐渐疲软,这种情况一直持续到2024年第一季度。

正如所传达的那样,对于 2024 年全年,该公司预计销量、产品组合和价格的净影响将略高于上一年。额外的动力应该来自新的 5 系列和7 系列车型的更好可用性第一个完整的年度带来了更强大的产品组合。

汽车部门的息税前利润也受到销售和管理成本上升的影响,

主要原因是从2023年第三季度开始实施的IT项目和人员成本增加。

根据其战略计划,宝马集团今年对未来的投资比以往任何时候都多。研发费用和资本支出计划创下历史新高:宝马集团始终致力于创新、高效和低排放技术,以及产品系列和公司的进一步电气化和数字化。

基于目前的经营业绩实力,宝马集团第一季度研发费用为19.74亿欧元( 2023年:15.54亿欧元/+27.0% ),大幅高于上年。支出主要集中在车队的进一步电气化和数字化,以及自动驾驶功能的持续开发。开发支出还用于即将推出的 NEUE KLASSE 车型以及 BMW X5 等后续车型。

研发比率(根据德国商法典)增加至5.4%(2023 年:4.2%)。宝马集团预计全年这一比率将超过5.0%。

今年第一季度,汽车业务的自由现金流 受到 营运资金增加的影响,这是由于库存水平较高,以确保向销售市场提供适当的供应以及客户可以接受的交货时间。

13.23亿欧元 的资本支出(不包括资本化开发成本)分配给包括车辆项目设施在内的设施,重点是电气化和数字化(2023 年:13.28 亿欧元/-0.37% )。资本支出 率为3.6%(2023 年:3.6%)。公司预计全年这一比例将超过6%。

2024 年第一季度,未来模型和创新的总投资达23 亿欧元。尽管如此,汽车部门产生了12.83 亿欧元(2023 年:19.81 亿欧元/-35.2% )的自由现金流。

尽管研发和资本支出的投资将在 2024 年达到峰值,但宝马集团全年的目标是汽车领域的自由现金流超过60 亿欧元。

“长期战略方针,加上我们日常业务的最大灵活性以及对盈利能力的明确关注——这就是宝马集团强劲的经营业绩的原因。凭借这一优势,我们能够凭借多样化的电气化和数字化产品,为公司的深远转型奠定良好的基础。今年,维持我们的战略方针比以往任何时候都更加重要。我们公司的数字和电力未来所需的投资是有史以来最高的。”负责财务的管理委员会成员Walter Mertl说道。 “我们对未来充满信心——因为我们正在建立极具吸引力的产品和品牌以及我们的财务实力。”

金融服务新业务强劲增长

宝马集团金融服务融资租赁业务在2024年第一季度继续保持强劲发展。终端客户新零售业务强劲增长:新签合同数增长 21.5%,达到422,056份 (2023年: 347,298 份合同)。

与零售客户的融资和租赁合同相应的新业务总量为156.2亿欧元(2023年:127.88亿欧元/+22.1% )。截至第一季度末,宝马集团新车中由金融服务部门租赁或融资的比例达到41.8 % (2023年:36.5%/+5.3个百分点)。

在这三个月期间,该部门的税前收益为 7.3 亿 欧元(2023 年:9.45 亿欧元/-22.8%)。较高的风险拨备和租赁期满车辆转售收入较低对上一年的盈利产生了抑制作用。正如预期的那样,二手车市场的价格继续下跌。报告期内,整个贷款组合的信用损失率保持在0.21%的低水平(2023年:0.13%)。宝马集团金融服务已制定了充分的风险拨备。

宝马摩托车赛季开局强劲

第一季度,宝马摩托车向客户交付了46,434 辆摩托车和踏板车。总体而言,宝马摩托车预计今年对其年轻产品线的需求将保持强劲。新车型,尤其是 F 800 GS、F 900 GS 和 R 1300 GS,自上市以来就受到强劲需求,进一步支持了该细分市场的增长战略。息税前利润率为12.2 %(2023 年:16.5%),超出了 8-10% 的全年指导目标范围。

宝马集团确认指导意见

预测预计 2024 年全球经济增长将小幅增长 3.2%。如果许多市场目前的经济复苏持续下去,增长可能会更加强劲。然而,现有冲突升级以及地缘政治紧张局势可能加剧可能会产生负面影响。

宝马集团预计将利用其在全球主要地区的平衡定位参与这一增长。

鉴于对其有吸引力的高档汽车的持续需求,宝马集团确认了今年的指导方针。该公司预计2024 年全球客户交付量将略有增长。

与上一年相比,由于制造和固定成本,特别是人员成本和研发费用增加,预计集团税前利润将略有下降。预计二手车价格的下降也将促进这一发展。

宝马集团预计全年汽车业务的息税前利润率在8-10% 之间。

对于摩托车细分市场,预计交付量将略有增加,息税前利润率将在8-10%的目标范围 内 。

金融服务部门的股本回报率 ( RoE )预计在14% 至 17%之间。

这些目标将通过稍微增加员工人数来实现。

本指引假设地缘政治和宏观经济状况不会大幅恶化。鉴于现有风险和机遇存在诸多不确定性,宝马集团的实际经营业绩可能与当前预期存在偏差。

| 宝马集团 – 概览:2024 年第一季度 | 2024 年第一季度 | 2023 年第一季度 | 在某一方面的变化 % | |

| 交付给客户 | ||||

| 汽车1 | 单位 | 594,533 | 588,138 | 1.1 |

| 其中:宝马 | 单位 | 530,933 | 517,957 | 2.5 |

| 小型的 | 单位 | 62,075 | 68,541 | -9.4 |

| 劳斯莱斯 | 单位 | 1,525 | 1,640 | -7.0 |

| 摩托车 | 单位 | 46434 | 47,935 | -3.1 |

| 员工人数(截至 2023 年 12 月 31 日) | 154,950 | |||

| 息税前利润率 汽车板块 | 百分 | 8.8% | 12.1% | -27.5 |

| 息税前利润率 摩托车部门 | 百分 | 12.2% | 16.5% | -26.4 |

| EBT 利润率 BMW Group 2 | 百分 | 11.4% | 13.9% | -18.0 |

| 收入 | 百万欧元 | 36,614 | 36,853 | -0.6 |

| 其中:汽车 | 百万欧元 | 30,939 | 31,268 | -1.1 |

| 摩托车 | 百万欧元 | 第872章 | 第933章 | -6.5 |

| 金融服务 | 百万欧元 | 9,525 | 8,826 | 7.9 |

| 其他实体 | 百万欧元 | 4 | 3 | 33.3 |

| 淘汰赛 | 百万欧元 | -4,726 | -4,177 | 13.1 |

| 财务业绩前利润 (EBIT) | 百万欧元 | 4,054 | 5,375 | -24.6 |

| 其中:汽车 | 百万欧元 | 2,710 | 3,777 | -28.2 |

| 摩托车 | 百万欧元 | 106 | 154 | -31.2 |

| 金融服务 | 百万欧元 | 第714章 | 958 | -25.5 |

| 其他实体 | 百万欧元 | -5 | -4 | 25.0 |

| 淘汰赛 | 百万欧元 | 第529章 | 第490章 | 8.0 |

| 税前利润 (EBT) | 百万欧元 | 4,162 | 5,129 | -18.9 |

| 其中:汽车 | 百万欧元 | 2,703 | 3,828 | -29.4 |

| 摩托车 | 百万欧元 | 106 | 154 | -31.2 |

| 金融服务 | 百万欧元 | 第730章 | 945 | -22.8 |

| 其他实体 | 百万欧元 | 401 | -128 | -413.3 |

| 淘汰赛 | 百万欧元 | 222 | 330 | -32.7 |

| 团体所得税 | 百万欧元 | -1,211 | -1,467 | -17.5 |

| 净利 | 百万欧元 | 2,951 | 3,662 | -19.4 |

| 普通股每股收益 | 欧元 | 4.42 | 5.31 | -16.8 |

| 优先股每股收益3 | 欧元 | 4.42 | 5.31 | -16.8 |

| 1交付量包括合资企业沉阳华晨宝马汽车有限公司 | ||||

| 2集团税前盈利与集团收入的比率。 | ||||

| 3 股普通股/优先股。优先股每股收益是通过在相应财政年度各季度按比例分配每股优先股 0.02 欧元额外股息所需的收益来计算的。 | ||||

术语表——关键绩效指标的解释性评论

交付给客户

新车或二手车一旦移交给最终用户(还包括与 BMW 金融服务签订租赁合同的承租人),即记录为交付。在美国和加拿大,最终用户还包括 (1) 将车辆指定为服务借用车或演示车辆时的经销商,以及 (2) 在拍卖中购买公司车辆时的经销商和其他第三方以及购买公司车辆时的经销商直接来自宝马集团。交付可由 BMW AG、其国际子公司之一、BMW 集团零售店或独立第三方经销商进行。绝大多数交付(以及向宝马集团报告的交付情况)都是由独立的第三方经销商完成的。特定报告期内的零售车辆交付量与宝马集团在该特定报告期内确认的收入并不直接相关。

息税前利润

先利润后财务结果。财务业绩前利润包括收入减去销售成本、减去销售和管理费用以及加上/减去其他净营业收入和费用。

息税前利润率

未计财务结果的损益占收入的百分比。

EBT

息税前利润加上财务业绩。

插电式混合动力汽车

插电式混合动力电动汽车。

宝马集团

宝马集团拥有 BMW、MINI、劳斯莱斯和 BMW Motorrad 四个品牌,是全球领先的优质汽车和摩托车制造商,并提供优质金融和移动服务。宝马集团的生产网络由全球 30 多个生产基地组成;公司在全球140多个国家拥有销售网络。

2023年,宝马集团在全球销售了超过255万辆乘用车和超过209,000辆摩托车。 2023 财年税前利润为 171 亿欧元,收入达 1,555 亿欧元。截至2023年12月31日,宝马集团拥有154,950名员工。

宝马集团的成功始终基于长期思考和负责任的行动。该公司很早就为未来制定了路线,并始终将可持续发展和高效资源管理作为其战略方向的核心,从供应链到生产再到所有产品的使用阶段结束。

www.bmwgroup.com

二氧化碳排放和消耗。

BMW i4: WLTP 综合:能耗 19.4-15.1 kWh/100km;二氧化碳排放量0克/公里; CO2 A 级;航程386-600公里

BMW iX1 xDrive30 :综合能耗:16.9 kWh/100 km (WLTP);二氧化碳排放量 0 克/公里(WLTP); CO2 等级:A;续航里程:439 公里(WLTP)

BMW i7 eDrive50 :综合能耗:19.2 kWh/100 km (WLTP);二氧化碳排放量总计 0 克/公里 (WLTP); CO2 等级:A;耗电量:610公里(WLTP)

BMW iX2 eDrive20 :综合能耗:15.3 kWh/100 km (WLTP);二氧化碳排放量总计 0 克/公里 (WLTP); CO2 等级:A;耗电量:478公里(WLTP)

BMW i5 eDrive40 豪华轿车 :综合能耗:16.3 kWh/100 km (WLTP);二氧化碳排放量总计 0 克/公里 (WLTP); CO2 等级:A;耗电量:571公里(WLTP)

MINI Countryman: l/100km 综合能耗:6.2;二氧化碳排放量合计克/公里:141; CO2 E 级

MINI Cooper 3-Türer: l/100km 综合能耗:6.4;二氧化碳排放量合计克/公里:144; CO2 E 级

MINI Aceman E:综合耗电量:14.7 – 14.1 kWh/100 km(根据 WLTP);二氧化碳排放量合计:0克/公里; CO2 级:A;根据 WLTP 的续航里程(公里):298 – 310

劳斯莱斯 Spectre:能耗:23.6 kWh/100 km (WLTP);二氧化碳排放量总计 0 克/公里 (WLTP); CO2 A 级;耗电量:500公里(WLTP)

Robust results within full-year guidance: BMW Group has a successful start to 2024

08.05.2024

+++ Consistent strategic implementation: Dynamic BEV ramp-up aligned with profitability, as planned +++ BEV ramp-up continued as planned: 28% growth to around 83,000 BEVs in Q1 +++ BMW brand sales increased by 2.5% +++ Deliveries of models in the upper price segment rise by over 20% +++ Group EBT margin above target of >10% in Q1 +++ EBIT margin within the target range of 8-10% for nine consecutive quarters +++ Outlook for 2024 confirmed +++

Munich. The BMW Group continues its successful course in 2024: parallel to its dynamic BEV ramp-up, the company achieved its margin targets. In the first three months of the year, the company delivered around 83,000 all-electric vehicles from its BMW, MINI and Rolls-Royce brands and increased BEV sales by around 28 percent. The BMW brand overall increased its sales by 2.5%. At the same time, the EBIT margin in the Automotive segment of 8.8 percent was within the target range of 8-10 percent, according to the full-year guidance. At 11.4 percent, the EBT margin at Group level was above the strategic target of >10 percent.

After the challenges of the corona pandemic and semiconductor availability, the company has consistently delivered quarter by quarter within its 8-10% strategic EBIT corridor since Q1 2022. This has been achieved in parallel to its rapid ramp-up of electric mobility: Over the past two years, the BMW Group delivered more than 1.1 million electrified vehicles to customers. More than 60 percent of these were purely electric BEV models. The BEV share continues to rise steadily, as planned.

In the first quarter of 2023, the EBIT margin of Automotive segment was 12.1%. The EBIT of previous year’s first quarter benefited from the lower purchase price level of 2022, as inventories with lower manufacturing costs were sold. The inflation-related increase in manufacturing costs impacted the profit & loss statement of BMW AG after the second quarter of 2023. The higher cost level has carried through into Q1/2024.

“The past nine quarters underline BMW’s continuity and reliability: As planned, we are dynamically expanding the share of electric vehicles while maintaining our high level of profitability. Some call this transformation — for us, it is continuous progress,” said the Chairman of the Board of Management of BMW AG, Oliver Zipse, on Wednesday. “We will remain on this course: We offer our customers the latest innovations and the latest technology — across all vehicle drivetrains. As a result, we continue to generate strong demand with strong products.”

Automotive markets on upward trend – BMW Group deliveries increase

With a total of 594,533 automobiles delivered to customers in the first three months, the company posted a slight growth of 1.1% compared to the previous year and reaffirmed its leading position in the global premium segment.

Throughout the three-month period, the major automotive markets largely showed an upward trend based on catch-up purchases and increased sales in the mid-price volume segment. The BMW Group benefited with its young and highly attractive product line-up: The BMW brand sold 530,933 units in the first quarter – an increase of +2.5% year-on-year. It achieved sales growth of 2.4% (84,475 units) in the USA and significant growth of 10.2% in Europe with 188,863 units delivered. In China, the volume segment developed dynamically in lower price ranges, while the premium segment declined slightly. The BMW brand sold 182,998 vehicles, in line with segment development (2023: 190,774 units/-4.1%). In Germany, deliveries grew by 4.6% to 49,509 premium vehicles.

The popular BMW i4*, as well as the BMW iX1* and BMW i7*, were among the biggest growth drivers of the 78,682 BMW BEVs delivered. The BMW brand’s fully-electric vehicles saw particularly strong growth of +40.6%. A total of 122,582 BMW Group electrified vehicles, BEVs and PHEVs, were delivered to customers, which represents a sales share of almost 21%.

Further sales momentum is expected over the course of the year from the BMW iX2* and BMW i5*, which are currently ramping up.

Fully-electric models increased to 13.9% of total sales (2023: 11.0%). Once again, the models of upper price segments also proved to be important growth drivers – with deliveries up 21.6%.

The MINI brand is undergoing a comprehensive model changeover. For the first time, the new MINI Countryman*, was recently launched with a pure-electric drive train alongside the familiar internal combustion engine. This will be followed by the new MINI Cooper*, which comes in mid Q2 with a combustion engine or as a fully-electric vehicle. The all electric MINI Aceman* recently celebrated its world premiere at the Beijing Motor Show and is the brand’s first cross-over model for the premium small car segment. These new models are expected to deliver additional momentum from 2nd half of 2024. MINI delivered 62,075 vehicles to customers in Q1 (2023: 68,541 units/-9.4%).

The Rolls-Royce brand made an impressive e-mobility debut with the Rolls-Royce Spectre*: In the first quarter of 2024 alone, the Rolls-Royce luxury brand handed over 579 fully-electric super coupés to their new owners; 38% of the total 1,525 cars delivered were electrified (2023: 1,640 automotive/-7.0%).

Currency-adjusted Group revenues increased slightly

First-quarter Group revenues totalled € 36,614 millionand were, therefore, on par with the previous year’s record high (2023: € 36,853 million/-0.6%). Group revenues were buoyed by higher sales volumes and a more favourable product mix.

Group EBT margin outperforms target of >10%

Between January and March, the BMW Group reported pre-tax earnings (EBT) of € 4,162 mi llion(2023: € 5,129 million/-18.9%). The EBT includes a financial result of € 108 million (2023: € -246 million), which reflects the market development in interest rate and currency hedging transactions. The EBT margin for this period was 11.4% (2023: 13.9%) and was above the >10% full year target. Group net profit for the first quarter totalled € 2,951 million (2023: € 3,662 million/-19.4%).

BMW AG continues its share buyback programme

With the authorisation of the Annual General Meeting of BMW AG on 11 May 2022, the company initiated the purchase of shares. Shares purchased in programme one have already been cancelled. As of 31 March 2024, BMW AG holds 8,004,314 treasury shares, with a nominal value of € 8,004,314. Based on this authorisation, BMW AG purchased shares equivalent to 5.03% of the share capital as of March 31, 2024.

8.8% Automotive Segment EBIT margin within full-year target range

The Automotive Segment earned revenues of € 30,939 million in the first quarter (2023: € 31,268 million/-1.1%). Excluding currency translation headwinds, especially from the Chinese renminbi and the US dollar, revenues posted year-on-year growth of +1.5%. Higher sales volumes and more favourable product mix effects from the upper price segment and BEV bolstered segment revenues, underscoring the robust operating performance of the core business. Prices across the product range are expected in 2024 to be in line with last year’s level.

The Ea rnings before financial result (EBIT) totalled € 2,710 million for the first quarter (2023: € 3,777 million/-28.2%). The auto EBIT margin came in at 8.8% (2023: 12.1%) and was thus within the full-year target range of 8-10%. EBIT was impacted by higher manufacturing costs. As mentioned before, Q1 2023 had still benefited from the lower level of purchasing prices in 2022. Manufacturing costs increased starting with the second quarter of 2023 and has carried through into Q1/2024.

Changes in commodity prices accounted for a positive low three-digit million euro impact in EBIT, while currency effects remained neutral. For the full year 2024, the BMW Group anticipates a positive net balance from currency and commodity positions.

Resale results from end-of-lease vehicles proved to be a headwind against Q1/2023 yet remained positive. Starting with the second quarter of 2023, the competitive environment has intensified due to a better availability of vehicles. This has led to a gradual softening of the global price environment in the new and used car business which has continued into the first quarter of 2024.

For the full year 2024, the company expects net impact of volume, product mix and price to be slightly positive against the previous year, as communicated.Additional momentum should come from the new 5 series and the better availability of the 7 series models within the first full year leading to a stronger product mix.

EBIT of auto segment was also impacted by higher selling & administrative costs,

largely due to IT projects and the increase in personnel costs, which was implemented from the third quarter of 2023.

In line with its strategic plans, the BMW Group is investing more in its future this year than ever before. It plans to see record levels of R&D expenses and capital expenditure: The BMW Group is consistently focusing on innovations, efficient and low-emission technologies, as well as the further electrification and digitalisation of the product range and the company.

Based on the strength of its current operating performance, the BMW Group incurred R&D expenses of € 1,974 millio n (2023: € 1,554 million/+ 27.0%) in the first quarter, which were significantly higher than the previous year. Spending was mainly focused on further electrification and digitalisation of the vehicle fleet, as well as continued development of automated driving functions. Development expenditure was also directed towards upcoming models of the NEUE KLASSE as well as successor models such as the BMW X5.

The R&D ratio (according to the German Commercial Code) increased to 5.4% (2023: 4.2%). For the full-year, the BMW Group expects a ratio of over 5.0%.

In the first quarter of the year, free cash flow of automotive segment was affected by the increase in working capital due to higher inventory levels to ensure appropriate supply to sales markets with lead times acceptable to customers.

Capital expenditure of € 1,323 million (excluding captialized development costs)was allocated to facilities including facilities for vehicle projects, with a focus on electrification and digitalisation (2023: € 1,328 million/-0.37%). The capex ratio stood at 3.6% (2023: 3.6%). The company expects the ratio for the full year to be over 6%.

In Q1 2024, total investments of €2.3bn were made into future models and innovations. Nevertheless, segment Automotive generated € 1,283 million (2023: € 1,981 million/-35.2%) in free cash flow.

For the full year, the BMW Group is targeting a free cash flow in the Automotive Segment above € 6 billion, despite peak investments in R&D and CAPEX in 2024.

“A long-term strategic approach, coupled with maximum flexibility in our day-to-day business and a clear focus on profitability – that is what defines the BMW Group’s strong operating performance. With this strength, we are in a good position for our company’s far-reaching transition with a diverse range of electrified and digitalized products. This year, it will be more important than ever to maintain our strategic course. The investments needed in the digital and electric future of our company are the highest they have ever been,” said Walter Mertl, member of the Board of Management responsible for Finance. “We are confident about the future – because we are building on our highly attractive products and brands and on our financial strength.”

Financial services see strong growth in new business

The financing and leasing business of BMW Group Financial Services continued to experience dynamic development in the first quarter of 2024. New retail business with end customers saw strong growth: The number of new contracts climbed by 21.5% to reach a total of 422,056 (2023: 347,298 contracts).

The corresponding total volume of new business from financing and leasing contracts with retail customers was € 15,620 million (2023: € 12,788 million/+22.1%). The percentage of BMW Group new vehicles leased or financed by the Financial Services Segment reached 41.8% at the end of the first quarter (2023: 36.5%/+5.3 percentage points).

In the three-month period, the segment reported pre-tax earnings of € 730 m illion(2023: € 945 million/-22.8%). Higher risk provisioning and lower income from the resale of end-of-lease vehicles had a dampening effect on earnings against the previous year. As anticipated, prices in the used car markets continued to decline. During the reporting period, the credit loss ratio remained at the low rate of 0.21% across the entire loan portfolio (2023: 0.13%). BMW Group Financial Services has made adequate risk provisions.

BMW motorcycles with strong season start

In the first quarter, BMW Motorrad delivered 46,434 motorcycles and scooters to customers. Overall, BMW Motorrad expects demand for its young product line-up to remain robust this year. The new models, especially the F 800 GS, the F 900 GS and the R 1300 GS, are enjoying strong demand since their market launch, further bolstering the segment’s growth strategy. The EBIT margin of 12.2%(2023: 16.5%) exceeded the guided full-year target range of 8-10%.

BMW Group confirms guidance

Forecasts predict a slight increase of 3.2% in global economic growth for 2024. If the current economic recovery in many markets continues, growth could potentially be stronger. However, escalation of existing conflicts, with a possible increase in geopolitical tensions, could have a negative impact.

The BMW Group expects to participate in this growth, leveraging its balanced positioning across the world’s major regions.

Given the continuing demand for its attractive premium vehicles, the BMW Group confirms its guidance for the year. The company expects to see slight growth in customer deliveries worldwide in 2024.

Group earnings before tax are forecast to decrease slightly, due to higher manufacturing and fixed costs, particularly personnel costs and R&D expenses, compared to the previous year. The projected decrease in used car prices is also anticipated to contribute to this development.

The BMW Group expects an EBIT margin in the Automotive Segment of between 8-10% for the full year.

For the Motorcycles Segment, a slight increase in deliveries is forecast and an EBIT margin within the target range of 8-10%.

Return on equity (RoE) in the Financial Services Segment is projected to be between 14 and 17%.

These targets will be achieved with slightly higher employee numbers.

This guidance assumes that geopolitical and macroeconomic conditions will not deteriorate substantially. Given the many uncertainties surrounding the existing risks and opportunities, the BMW Group’s actual business performance may deviate from current expectations.

| The BMW Group – an overview: IN Q1 2024 | Q1 2024 | Q1 2023 | Change in % | |

| Deliveries to customers | ||||

| Automotive1 | units | 594,533 | 588,138 | 1.1 |

| thereof: BMW | units | 530,933 | 517,957 | 2.5 |

| MINI | units | 62,075 | 68,541 | -9.4 |

| Rolls-Royce | units | 1,525 | 1,640 | -7.0 |

| Motorcycles | units | 46434 | 47,935 | -3.1 |

| Employees (as of 31 Dec. 2023) | 154,950 | |||

| EBIT margin Automotive Segment | percent | 8.8% | 12.1% | -27.5 |

| EBIT margin Motorcycles Segment | percent | 12.2% | 16.5% | -26.4 |

| EBT margin BMW Group2 | percent | 11.4% | 13.9% | -18.0 |

| Revenues | € million | 36,614 | 36,853 | -0.6 |

| thereof: Automotive | € million | 30,939 | 31,268 | -1.1 |

| Motorcycles | € million | 872 | 933 | -6.5 |

| Financial Services | € million | 9,525 | 8,826 | 7.9 |

| Other Entities | € million | 4 | 3 | 33.3 |

| Eliminations | € million | -4,726 | -4,177 | 13.1 |

| Profit before financial result (EBIT) | € million | 4,054 | 5,375 | -24.6 |

| thereof: Automotive | € million | 2,710 | 3,777 | -28.2 |

| Motorcycles | € million | 106 | 154 | -31.2 |

| Financial Services | € million | 714 | 958 | -25.5 |

| Other Entities | € million | -5 | -4 | 25.0 |

| Eliminations | € million | 529 | 490 | 8.0 |

| Profit before tax (EBT) | € million | 4,162 | 5,129 | -18.9 |

| thereof: Automotive | € million | 2,703 | 3,828 | -29.4 |

| Motorcycles | € million | 106 | 154 | -31.2 |

| Financial Services | € million | 730 | 945 | -22.8 |

| Other Entities | € million | 401 | -128 | -413.3 |

| Eliminations | € million | 222 | 330 | -32.7 |

| Group income taxes | € million | -1,211 | -1,467 | -17.5 |

| Net profit | € million | 2,951 | 3,662 | -19.4 |

| Earnings per share of common stock | € | 4.42 | 5.31 | -16.8 |

| Earnings per share of preferred stock3 | € | 4.42 | 5.31 | -16.8 |

| 1 Deliveries include the joint venture BMW Brilliance Automotive Ltd., Shenyang | ||||

| 2 Ratio of Group earnings before taxes to Group revenues. | ||||

| 3 Common/preferred shares. Earnings per share of preferred stock are calculated by distributing the earnings required to cover the additional dividend of € 0.02 per preferred share proportionally over the quarters of the corresponding financial year. | ||||

GLOSSARY – explanatory comments on key performance indicators

Deliveries to customers

A new or used vehicle is recorded as a delivery once it is handed over to the end user (which also includes leaseholders under lease contracts with BMW Financial Services). In the US and Canada, end users also include (1) dealers when they designate a vehicle as a service loaner or demonstrator vehicle and (2) dealers and other third parties when they purchase a company vehicle at auction and dealers when they purchase company vehicles directly from the BMW Group. Deliveries may be made by BMW AG, one of its international subsidiaries, a BMW Group retail outlet, or independent third-party dealers. The vast majority of deliveries – and hence the reporting of deliveries to the BMW Group – is made by independent third-party dealers. Retail vehicle deliveries during a given reporting period do not correlate directly to the revenues that the BMW Group recognises in respect of that particular reporting period.

EBIT

Profit before financial result. Profit before financial result comprises revenues less cost of sales, less selling and administrative expenses and plus/minus net other operating income and expenses.

EBIT margin

Profit/loss before financial result as a percentage of revenues.

EBT

EBIT plus financial result.

PHEV

Plug-in-hybrid electric vehicle.

The BMW Group

With its four brands BMW, MINI, Rolls-Royce and BMW Motorrad, the BMW Group is the world’s leading premium manufacturer of automobiles and motorcycles and also provides premium financial and mobility services. The BMW Group production network comprises over 30 production sites worldwide; the company has a global sales network in more than 140 countries.

In 2023, the BMW Group sold over 2.55 million passenger vehicles and more than 209,000 motorcycles worldwide. The profit before tax in the financial year 2023 was € 17.1 billion on revenues amounting to € 155.5 billion. As of 31 December 2023, the BMW Group had a workforce of 154,950 employees.

The success of the BMW Group has always been based on long-term thinking and responsible action. The company set the course for the future at an early stage and consistently makes sustainability and efficient resource management central to its strategic direction, from the supply chain through production to the end of the use phase of all products.

www.bmwgroup.com

CO2 EMISSIONS & CONSUMPTION.

BMW i4: WLTP combined: energy consumption 19,4-15,1 kWh/100km; CO2 emissions 0 g/km; CO2 class A; range 386-600 km

BMW iX1 xDrive30 :energy consumption combined: 16,9 kWh/100 km (WLTP); CO2 emissions 0 g/km (WLTP); CO2 class: A; range: 439 km (WLTP)

BMW i7 eDrive50 : energy consumption combined: 19,2 kWh/100 km (WLTP); CO2 emissions combined 0 g/km (WLTP); CO2 class: A; electricity consumption: 610 km (WLTP)

BMW iX2 eDrive20 : energy consumption combined: 15,3 kWh/100 km (WLTP); CO2 emissions combined 0 g/km (WLTP); CO2 class: A; electricity consumption: 478 km (WLTP)

BMW i5 eDrive40 Limousine : energy consumption combined: 16,3 kWh/100 km (WLTP); CO2 emissions combined 0 g/km (WLTP); CO2 class: A; electricity consumption: 571 km (WLTP)

MINI Countryman: energy consumption combined in l/100km: 6,2; CO2 emissions combined g/km: 141; CO2 class E

MINI Cooper 3-Türer: energy consumption combined in l/100km: 6,4; CO2 emissions combined g/km: 144; CO2 class E

MINI Aceman E: electricity consumption combined: 14,7 – 14,1 kWh/100 km according to WLTP; CO2 emissions combined: 0 g/km; CO2-class: A; Range in km according to WLTP: 298 – 310

Rolls-Royce Spectre: energy consumption: 23,6 kWh/100 km (WLTP); CO2 emissions combined 0 g/km (WLTP); CO2 class A; electricity consumption: 500 km (WLTP)